Contact

Dustin Wiese

The timely and proper accounting of the financial application enables the student council and the institutions controlling it to track the proper use of the funds. The accounting must be designed in such a way that this is also possible for knowledgeable persons in a reasonable amount of time afterwards.

All of the following instructions are based on our grant and loan guidelines. It is recommended that you follow them, as this will allow the accounts to be checked more quickly. Deviations are best discussed with the Finance Department in advance.

The completed accounts (+ receipts) must be stapled and not in transparent sheets and must be received in the StuRa office (House A, basement, room 013). Communication with the Finance Department and digital documents must be submitted via ref-finanzen@stura.tu-ilmenau.de.

Deadlines

Statements of accounts are to be submitted by 6 months after the end of the project. If the funds of the project are still to be drawn from the current budget year, the statement of account must be submitted in good time before the end of the budget year. Early February is recommended in this case.

The Student Council can extend the deadline for the final account upon request, provided there is an important reason. If the support of the StuRa is not to be used, we ask for a short notification.

General Requirements

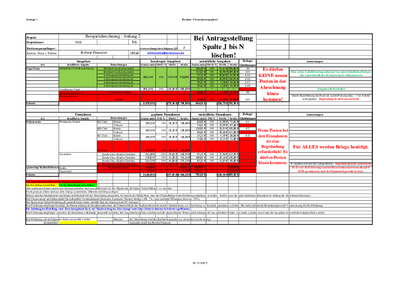

- Use of the template for the statement

- The requested totals should be next to the actual totals.

- Amounts for items from the approved budget should be presented in the same manner in the statement.

- No new items may be added to the statement. Items may be itemized based on different supporting documentation or taxation at most. (Example Appendix 2)

- New items in the "type" and "detailed specification" columns are not allowed. (see Appendix 2 "Traffic Signs AVS" and "Maintenance Beamer").

- New items in the "Remarks" column with related details of expenses are only allowed if it is a breakdown due to different supporting documents and/or different taxation. (see appendix 2 under "Liability/accident insurance")

- Subtotals must be clearly identified and shown under the itemized totals. Making the line bold is not sufficient in this regard.

- At least one corresponding receipt must be submitted for each expenditure or revenue item and indicated directly at the item.

- An assurance must be provided that the receipts and expenditures are complete and true, that the services are used exclusively for the funded project, and that the expenses are covered by the grant.

Content requirements

- Deposits are not subsidized and must be deducted from receipts. Only in exceptional cases with qualitative justification, pledge can be accounted for.

- If the expenses decrease in such a way that a revenue surplus arises, then first the subsidy granted by the StuRa is to be reduced. Only when this has fallen to 0 EUR, the own contribution may be reduced. (See appendix 2)

- If expenditure items from the budget are exceeded, a justification is always required.

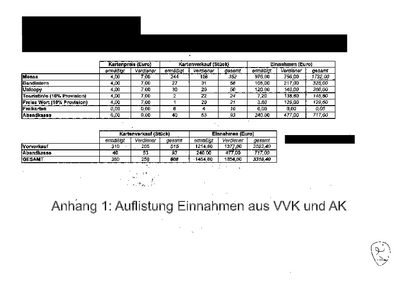

- If revenue items are undershot and it is not income from ticket sales or similar, a justification is always required here as well. An almost perfect example of a receipt for income from box office and advance sales can be seen in the appendix.

The following documents would be additionally very helpful

- The overviews should be submitted electronically, if they were created electronically. They should be .xlsx or similar files.

- Scanned copies of the supporting documents and the overviews, if applicable, should be submitted electronically. These should be PDF files.

- A written (signed) version should always be submitted.

The bank details (IBAN) should be indicated on the documents so that a bank transfer can be made.

Requirements for receipts

- Receipts for expenditures should be invoices according to UStG §14 or simplified invoices according to UStDV.

- Vouchers must be numbered uniquely and consecutively and must be arranged according to the items of the budget. Each document must have its own number.

- If the Recipient is not entitled to deduct VAT, the receipts do not need to show VAT.

- For the use of a private vehicle for passenger transport, only a mileage allowance (max. 17 cents per kilometer as well as 0.2 cents per kilometer and passenger) can be charged, for which a logbook must be kept as well as the explicit mention in the finance plan. For possible detours, a justification must always be given.

- For receipts, receipts are to be issued if possible or alternatively own receipts are to be prepared.

- Cash books are to be kept and submitted for cash tills.

- The original receipts must be attached. If these cannot be submitted, for example, because they are with the tax advisor, this must be stated and copies of these receipts must be submitted instead.

- Receipts on thermal paper or similar must always be submitted additionally as a copy.

- If more than 15 receipts are to be assigned to a project, a tabular overview of the receipts must be prepared. The following information should be available from this table:

- Cost center (type)

- Position (detailed information + possibly remark)

- Document date

- Amount

- Voucher issuer (e.g. Kaufland)

- Number (number given by the customer)

- if necessary: remark

- If a tabular overview of the receipts has been created, the numbers of the receipts must still be assigned in the settlement in the column Receipts/receipts.